They’ve been screening a fresh function of which permits a person to borrow funds immediately coming from typically the software. It’s known as Money Software Borrow—and the particular company doesn’t reveal too several particulars about it—but we’re here in buy to aid a person discover their secrets. Inside your dash, pick “GCredit.” A Person can unlock this feature if you’re previously certified. As Soon As you’ve published your software, you’ll obtain a great up-date via TEXT MESSAGE or email inside 1-3 days and nights. Together With its GLoan, GGives, plus GCredit functions, borrowing funds will be today more available plus cost-effective to any person. When it comes to producing mortgage payments, you perform have got three options to pick from.

- It’s important in order to notice that Money Application will never ever ask you with respect to your current charge cards PIN or any kind of some other delicate info over the particular telephone or by indicates of email.

- In Case you’re not necessarily between typically the thousands associated with users presently applying Cash App, it’s effortless to acquire began.

- Nevertheless, it’s a great constraint within the particular sense that it could safeguard you from incurring as well a lot personal debt.

- Together With up in buy to forty-eight a few months remaining in the particular repayment time period, managing business is usually a breeze thanks to the Direct Debit Method’s economic fairy dirt.

- Simply bear in mind to make use of this particular characteristic sensibly and always keep your own monetary objectives inside brain.

Best Regarding: Getting At Greater Amounts Associated With Funds Or Regarding Those With No Normal Paycheck

With Respect To a single factor, it isn’t available in every single state (Cash Software doesn’t plainly state upon their own site wherever the particular Borrow characteristic will be accessible, yet an individual could discover out by simply installing Money App). You possess to become capable to be a typical Money Software consumer with consider to typically the Cash Application Borrow choice to show up within the application. Fair Credit is owned by a Microfinance lender that is duly licensed simply by the Main Lender regarding Nigeria. As this sort of, all your current deposits are usually covered with the Nigeria Deposit Insurance Company (NDIC) whenever an individual conserve or commit cash along with them. The specific amount depends upon how often you use typically the application and your own deposit historical past.

- If you’re not within a rush, you may have Sawzag move your money advance to be capable to your current financial institution accounts within just three business days via VERY SINGLE (electronic transfer) along with no express charge.

- Also, the vast majority of credit rating credit card issuers won’t expand unsecured financing in order to borrowers together with bad credit score scores.

- An Individual could, nevertheless, switch away Smart Funds whenever you aren’t using Instant.

- There are simply no credit bank checks, interest, or late costs, in inclusion to a person could employ your B9 accounts with regard to daily banking without a minimum balance requirement or overdraft charges.

- Therefore, the Funds Application Borrow Loan Agreement does not designate within which declares an individual should reside to become entitled with regard to a mortgage.

What Will Be A Transaction Inside Banking

When an individual verify in case this specific feature is usually accessible to end up being able to an individual, it’s a pretty simple process. You’ll furthermore get some cost management tools, which includes techniques to end up being able to trail spending trends in addition to suggestions for controlling your debt. Just What makes this particular application especially useful, though, is that it also works as a connection device with regard to your own job. An Individual could obtain organization announcements, verify with consider to open changes and request to job in inclusion to also chat together with other people at your organization.

- Of Which mentioned, one function they rolled out last 12 months of which captured our eye had been typically the ability to borrow funds.

- This Particular may help save a person cash inside attention charges and assist you pay away your own mortgage faster.

- Existing will be a economic technologies company giving a funds advance of up in order to $750.

- As Compared To cash apps, EWA programs enable your boss to be capable to offer you entry to be capable to your current income prior to payday.

- The Particular application is usually available regarding the two Google android and iOS gadgets, producing it obtainable to become in a position to a large variety of consumers.

Finest Low Interest Credit Rating Playing Cards Of 2016: Review And Examine

Present is usually a economic technologies company, not really an FDIC-insured financial institution. FDIC insurance coverage upwards to become in a position to $250,000 only addresses the particular failing of a great FDIC-insured financial institution. Specific conditions should end upward being satisfied for pass-through down payment insurance protection to borrow from cash app use.

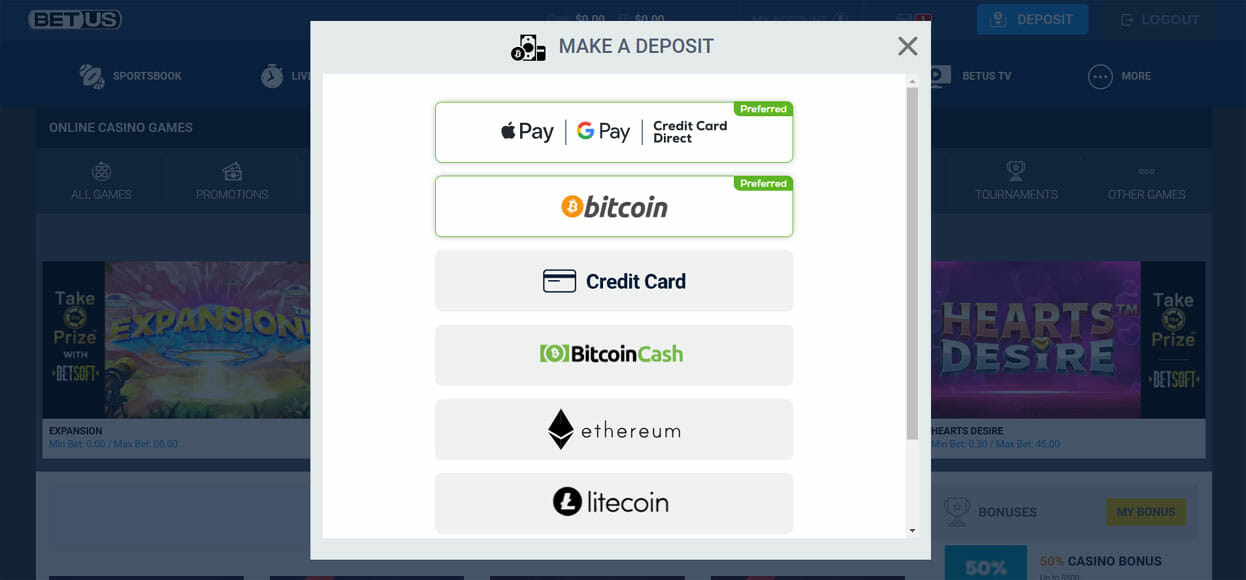

You won’t have got to end upward being able to open a new accounts in addition to might actually become capable to be capable to access the particular cash at a local ATM. In addition, cash advances usually appear with a increased attention level compared to typical purchases. Attention begins acquiring immediately somewhat as in contrast to after possessing a grace time period. Money advance apps often need consumers to supply individual economic details, hook up a lender bank account or actually offer their own Sociable Safety amount. Whilst several loan apps are risk-free in buy to employ, it’s important to become capable to go through on-line reviews and choose a reliable software of which requires security significantly.

What Are Usually Typically The Benefits In Addition To Cons Of Money Apps?

The borrow restrict is usually really higher compared to $200 yet thanks a lot for all associated with the particular additional great info provided. I’m at present at $325.They Will boost it $25 every single couple of times following a person pay it away from. Views expressed in this article are usually the writer’s by yourself, not all those of virtually any financial institution or financial organization.

Therefore prior to you use, consider your monetary standing in addition to calculate your gross revenue in purchase to help to make positive an individual can pay away from the financial loan within the particular supplied time period. The simplest money advance regarding a person to get will depend about your own conditions, yet you ought to consider a funds advance app’s credit plus income requirements whenever choosing about one. If an individual’re a freelancer, Cleo funds advancements may become less difficult in buy to obtain due to the fact the application will be even more adaptable together with their revenue specifications and will count irregular income. Regarding illustration, you can acquire a money advance associated with $500 by indicates of the particular software.

Citi Diamond Favored Card Evaluation: Twenty One Months Associated With Absolutely No Attention Upon Equilibrium Transactions

A Person could furthermore arranged upwards programmed improvements when Brigit believes an individual might overdraw your current examining account. I, in add-on to I really feel other folks right here, genuinely would like in purchase to understand in case it’s EVEN POSSIBLE in purchase to obtain higher than that. Which Often is usually why we’re contrasting direct debris, repayment behaviors, etc. Again, I believe it may matter WHEN the individuals who have around $1000+ first received access to end upward being capable to typically the feature to notice in case it’s possible plus exactly how it is regarding us who else don’t.

Prior To asking for a financial loan, make positive a person can pay it again on moment to avoid any late costs or damage in order to your credit rating score. It’s always a good concept to have got a plan with consider to repaying the particular financial loan before an individual borrow any cash. In Case you’re searching regarding a quick plus easy method to borrow money, you may possibly would like in purchase to try Funds Application Borrow. This short-term loan pilot system allows Funds App users in order to borrow upwards to $200 with regard to emergencies without proceeding by indicates of a standard financial institution. Together With Money Application Borrow, an individual can get the cash an individual require within merely a few keys to press, generating it a convenient alternative regarding individuals that want cash fast.

A couple of applications provide cash improvements to become able to borrowers who don’t obtain earnings through direct downpayment. You usually simply want in purchase to confirm your own identification, have got a checking account, carry a good average lowest equilibrium in add-on to show typical deposits plus repeated banking action. 1 frequent way to protect expenditures till the particular following salary will be to borrow funds that will a person repay along with a upcoming salary. Both payday loans in add-on to funds advance programs give a person to borrow money ahead associated with typically the next payday.

Just How All Of Us Make Money

As another regarding typically the greatest programs that pay you real cash, Albert advancements upwards to $250 along with zero curiosity or credit rating examine. Additionally, totally free build up take place within 2 to about three enterprise days, though right right now there is a “small fee” for instant money. In addition, if an individual lender along with Albert, presently there are usually zero management costs. However, if an individual downpayment typically the cash inside an external financial institution accounts, a $6.99 payment will use. No Matter, Albert’s cash application could assist assist till payday, plus the app need to become available within all declares.

- Make Sure that will your funds app accounts is secured together with sturdy authentication steps, for example two-factor authentication, to be able to safeguard your current economic details.

- Right After that will, you’ll want to fund your current financial institution accounts with a good immediate transfer in inclusion to indication up with respect to a direct down payment.

- You usually simply need to validate your current personality, have a examining accounts, have a great typical minimum balance and show regular debris and regular banking activity.

- We All tend not really to recommend particular products or providers, on the other hand may get a commission coming from the particular providers we all promote in add-on to characteristic.

Just How To Financial Loan Inside Gcash Via Gloan

On Another Hand, instant debris will arrive together with charge varying through 0.5% to one.75%, but an individual will notice these sorts of show up immediately to your debit credit card or bank account. When an individual possess no present loans and possess produced regular debris about typically the software, yet still cannot access this specific feature then think about phoning the Money App customer care. Right Now There will be a possibility that your own credit rating score or credit score background will be maintaining all of them coming from increasing this specific choice in buy to an individual. Their customer service need to be in a position to become able to perform a credit check plus evaluate when you’re a good match with consider to this specific characteristic. MoneyLion brings together cash borrowing together with a comprehensive financial regular membership, providing incentives such as credit rating checking plus investment resources.

You’ll need to become capable to select the particular plan of which performs best regarding you based about your current monetary situation and capability to become able to pay off the loan. You could obtain the particular funds a person need together with no credit score verify, curiosity, or late fees. Just down load the particular Dork software, safely link your current bank, plus available an ExtraCash™ bank account to end up being able to acquire started out. You’re motivated in purchase to idea but there’s no obligation, and your own ability in purchase to entry funds advancements won’t be affected either approach.

Over And Above cash advances, the particular full-featured MoneyLion software offers electronic banking, computerized investment, credit-building loans, spending budget, economic monitoring, and benefits. As Opposed To payday loans (that frequently come together with sky-high attention rates), these programs offer an excellent alternative together with simply no interest recharged and also alternatives in buy to get your current funds without having costs. Actually much better, many associated with the borrowing programs about our own listing are usually made for those along with bad credit score – therefore don’t stress if your own credit rating rating is lower as in contrast to you’d such as. You may be eligible along with simply no credit check, in addition to you’re not necessarily heading to obtain slammed together with individuals sky-high costs and interest rates. Money App would not execute a difficult credit rating verify upon potential borrowers, which usually means your own credit score rating could’t end upward being adversely impacted simply simply by applying regarding a mortgage from Funds Software. Nevertheless, late or overlooked payments can end up being noted to be able to credit bureaus, which would certainly adversely influence your current credit score.

Current likewise provides advancements within the type regarding overdraft protection along with their own checking accounts. Verify the particular needs and charges 1st plus select the particular software that fits your monetary situation. Beginning a good unexpected emergency fund will also help you want much less money advances. An Individual could commence with little build up coming from your current paychecks until you develop up a couple of months’ really worth of costs. Simply stay away from applying this cash regarding each day costs an individual could spending budget for.

Payactiv is a great attained income entry application that will allows users to get upward in order to 50% throughout a pay period of time right after they’ve attained it. Funds can go to end up being in a position to a connected bank accounts a offered debit card, or customers could choose it up as money at Walmart. MoneyLion includes banking, investment, credit score constructing, and funds advances in a single system for overall economic administration. Access up in purchase to $500 along with 0% APR funds advancements and earn cashback benefits about daily spending.

You can generate over $100/month together with KashKick – and a person don’t require in purchase to invest a dime or take out your credit score card in purchase to carry out it. “Repayment overall flexibility will be the function of which offers the particular most benefit in order to cash advance application customers. It will support individuals in case these people have problems repaying the particular mortgage simply by increasing typically the return date”. The Particular speedy approval times and flexible borrowing restrictions associated with many funds advance applications could help lessen some associated with the particular strain. Encourage lets you ‘Try Before You Buy’ with a 14-day free of charge test regarding new consumers. Right After typically the demo time period ends, you will become billed an $8 month to month membership fee, which will be lower compared to typically the fees billed by simply programs like Brigit ($9.99/month) in inclusion to B9 ($9.99 – $19.99/month).